Inflation, tariffs and demand declines weigh on hotel performance

Attention planners. Please note the metaphorical seat belt sign overhead and remain in your seats as we approach the end of the year.

Smart Meetings sat down with Jan Freitag, national director of hospitality market analytics at CoStar Group, to discuss the biggest trends impacting the hotel industry in the latter half of 2025 and make some predictions for 2026.

Inflation and Tariffs

A significant factor to consider in this equation is the rise in inflation and the newly activated tariffs that have a trickle-down effect.

“If I had to sum it up in one headline…it’s bumpy,” Freitag said, noting RevPAR has declined for four consecutive quarters, paired with four months of group demand decline.”

Read More: How High Will U.S. Hotel Rates Go in 2026?

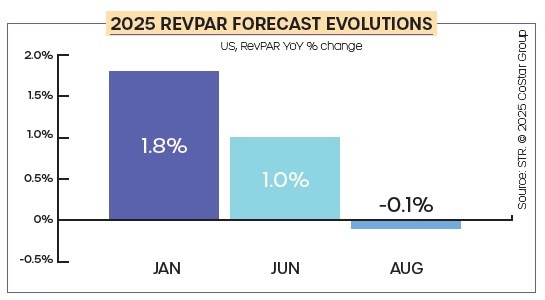

CoStar’s data shows the 2025 RevPAR forecast diminishing from +1.8% in January to +1.0% in June and –0.1% in August.

“We went from growth to no-growth in four months,” Freitag continued. “That shows the impact of tariffs, inbound travel decline and inflation.”

Occupancy Forecast

Additionally, data shows supply +0.8%, demand –0.1%, occupancy 62.5%, ADR +0.8%. The 2026 forecast is supply +0.8%, demand +0.6%, occupancy 62.3%, ADR +1.0% and RevPAR +0.8%.

“If I had to sum it up in one headline…it’s bumpy.”

“If I had to sum it up in one headline…it’s bumpy.”

– Jan Freitag

“We’re growing the top line much less than inflation, while expenses go up much faster. That means margins are getting squeezed,” Freitag said.

Group vs. Transient

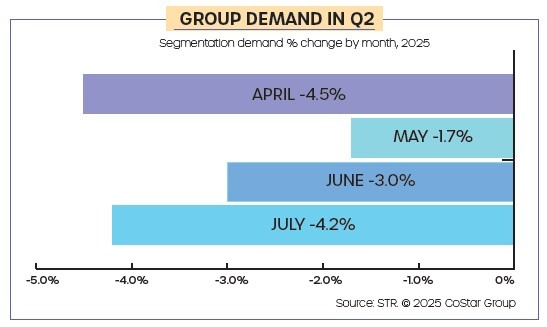

Freitag also noted transient travel was strongest earlier in 2025, but group travel fell in Q2, with –4.5% in January, –4.2% in April and –3.0% in June.

The data shows that group ADR rose from +3.3% to +3.4%.

“Group demand is going down because they don’t have the money. But if they are going, they’re still paying the rate that was negotiated,” Freitag said.

Corporate Travel, Hotels and Airlines

Companies have scaled back corporate travel as well.

“Part of what they’re cutting is corporate group demand. That’s the easier lever to pull when margins are uncertain.”

Airlines reported strong demand during the summer and fall, specifically in premium cabins, demonstrating that top-tier travel remains resilient.

Hotels, meanwhile, are preparing for a less-than-desirable fourth quarter due to inflated demand comparisons from the 2024 hurricane displacement.

“Fourth quarter is going to be negative nationally because of that,” Freitag said.

The 2026 Outlook

Looking forward to 2026, Freitag predicts that RevPAR will be +0.8% versus –0.1% in 2025, with stronger growth in the second half among luxury and upper-upscale segments.

Key factors include:

- Stabilized tariffs

- Tax cuts absorbed into the economy

- Weaker dollar boosting inbound travel

- Demand from the World Cup 2026 is impacting Canada, Mexico and the United States

“The second half of 2026 is going to be stronger than the first,” Freitag said.

Bleisure and One-Stop Venues

To get the details on hotel interior trends, Smart Meetings spoke with a representative from Teneo Hospitality Group to understand what planners and their attendees are excited about.

Read More: Work Hard, Play Harder: The $3.5 Trillion Bleisure Industry

One-stop-shop venues are lucrative now, and venues that incorporate a local angle also rank high in interest.

In addition, built-in activities that take attendees out of the break room and into an engaging space are in demand. Whether it is a high-tech wellness facility at Lake Nona Wave Hotel, a beach cleanup at Isla Bella Beach Resort, a Formula One event at Circuit of the Americas in Austin, a hot-air balloon adventure or an Air Force Academy simulator at Hotel Polaris in Colorado Springs, these options help planners create buzz in pre-event marketing. They are likely to leave a lasting impression on attendees.

This article appears in the September 2025 and September/October 2025 issues. You can subscribe to the magazine here.